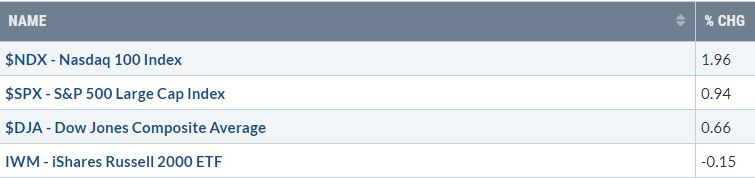

WEEKLY MAJOR INDEX PERFORMANCE

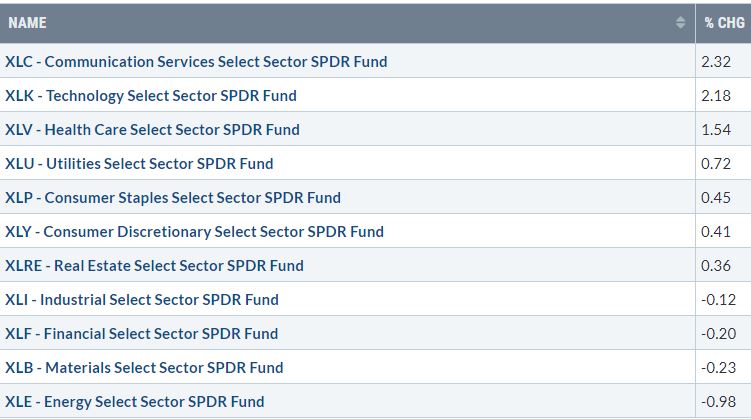

WEEKLY SECTOR PERFORMANCE

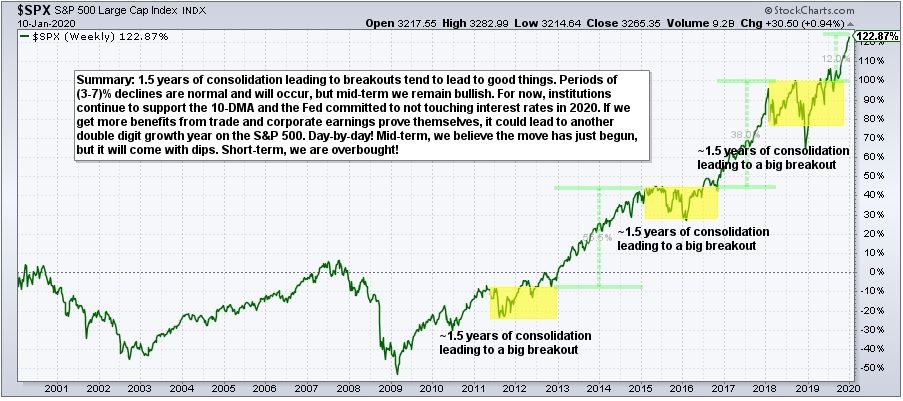

It was another strong week for the stock market. As previously mentioned, as we ride-the-wave higher, we will back-off risk. After Thursday’s advancement, we shifted some to risk-off assets. We now have a more conservative mix. Frankly, we love what we are seeing from a technical perspective, but short-term we are overbought. Mid-term, we like what we are seeing. On little dips, we will likely add hard.

This week there was a common theme of overnight drama leading to futures tanking overnight, only to get quickly bought-up and push us out of the $SPX $3214-$3258 range. We had over 5 tests at the $3214 support and boy did it ever hold strong. Strong support at the 10-Day Moving Average continues to be supported by institutions.

Next week we will hear more on the trade front. The question is whether this Street already has trade progress priced in? You don’t know; I don’t know; they don’t know. It will be interesting to see if some gains are taken ahead of earnings season kicking in. Once again, we aren’t selling or changing allocation because we think we are going to see a major dip. We are slowly reducing risk because of the velocity of the move and overbought nature of areas we were allocated. On dips, we will likely pounce back into similar areas that show relative strength. To be clear, there are opportunities, but I question the risk/reward at current levels. When I question the risk/reward, I feel it wise to take some gains off the table and wait for a dip. I am happy to admit if I am wrong in my decision. Thus far, our decision to shift to risk-off assets on Thursday, 1.9.2020, did payoff. As always, we will take this day-by-day.

Daily I ask myself, “Is the next 3% going to be up or down?” Being real, I do think a (2-3)% dip happens first. THIS WOULD BE A GREAT THING FOR THE MARKET. More monies would likely come in should we see a healthy dip. To be clear, there are opportunities. These are the times to be watching diligently to see how current leaders act during potential difficult times. This is where I look for potential during market consolidations. Downward or a longer sideways movements will have me adding again, likely. Overall, it has been a heck of a month and start to the year!

In the week ahead, we start off with a bang, as earnings season kicks back into gear with several bank stocks reporting. Bank stocks have had a nice run into earnings season. There will be more pressure on earnings with prices where they are.

- Tuesday: JPMorgan, Wells Fargo, and Citi report

- Wednesday: There is a supposed trade deal report along with Bank of America reporting

- Thursday: Morgan Stanley reports in addition to PPG and CSX

- Friday: We hear from Schlumberger

ADDITIONAL CHARTS

OPPORTUNITIES

Have a great weekend. Should you have questions or topics you’d like discussed, feel free to reach out to us! Thanks for your support!

DISCLOSURE STATEMENT

This post is for informational use only. The views expressed are those of the author, Jonathan M. Gurney. This material is not intended to be relied upon as a forecast, research, or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed.