What a year! SHEEEEEESSHHHH. A couple of general reoccurring investment themes that I would like to recap (the younger you become aware and incorporate these rules the more grounded you will be as an investor):

- Emotions are likely the biggest detriment to your account balance.

- The market (S&P 500) saw a huge decline of ~(40)% all to gain it back while still in a pandemic. What is the theme here? “THE MARKET IS NOT THE ECONOMY AND WILL RECOVER BEFORE THE ECONOMY DOES!” This year is living proof.

- As it relates to the election: THE MARKET DOESN’T CARE ABOUT YOUR OPINION AS TO WHO SHOULD WIN THE ELECTION. In most cases, the market views the election as one less worry to work through once a president is announced. This year was living proof.

- When the market tanks and you have that gut-wrenching hunch that the world is ending, add as much as possible to your investment accounts so I can add to strong companies that got lumped into an exaggerated sell-off. This is a consistent theme, and if you did this, it was reflected in your performance.

- Many investors “see green and think green OR see red and think red.” Put another way, “there is nothing like price to change sentiment.” If you’re still lost, when the market is up, people think the market will keep going up; When the market is trending down, they assume the worst.

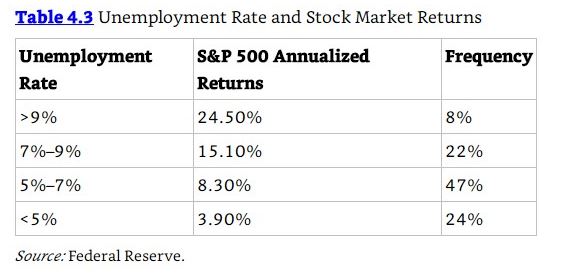

- Contrary to general logic, the market performs better when job numbers are worse. That’s right! Historically, the market has done better when unemployment numbers were higher. This year was living proof. It is easy to think, “Well, this time it could be different.” Sure, it could be… the market is a game of risk-reward and the market trends/themes tend to rhyme throughout history.

Areas this year where we did very well was preventing the dip. We saw over three (10)% declines this year and each time saved a lot of capital by increasing our cash position. Where I didn’t do well was holding/remaining risk-on until we got overbought. Truthfully, despite keeping up with retirement projections, there were lessons learned and things to improve upon. It has been a challenging year and a lot of growing pains to work through. Don’t get me wrong, we still had a decent year! This is direct as I can possibly be. This self-reflective review of my performance is what makes me who I am. I will improve from this and continue to improve. I encourage you all to do the same!

I expect volatility in January. I want to participate, but not get killed. These are historic runs. I expect next year to be fantastic, but early will likely come with a digestion of gains. As for now, price action is STRONG and we will ride it as long as possible. Note we have several of these digestions every year. These are normal dips that we will need to work through to get the large gains after.

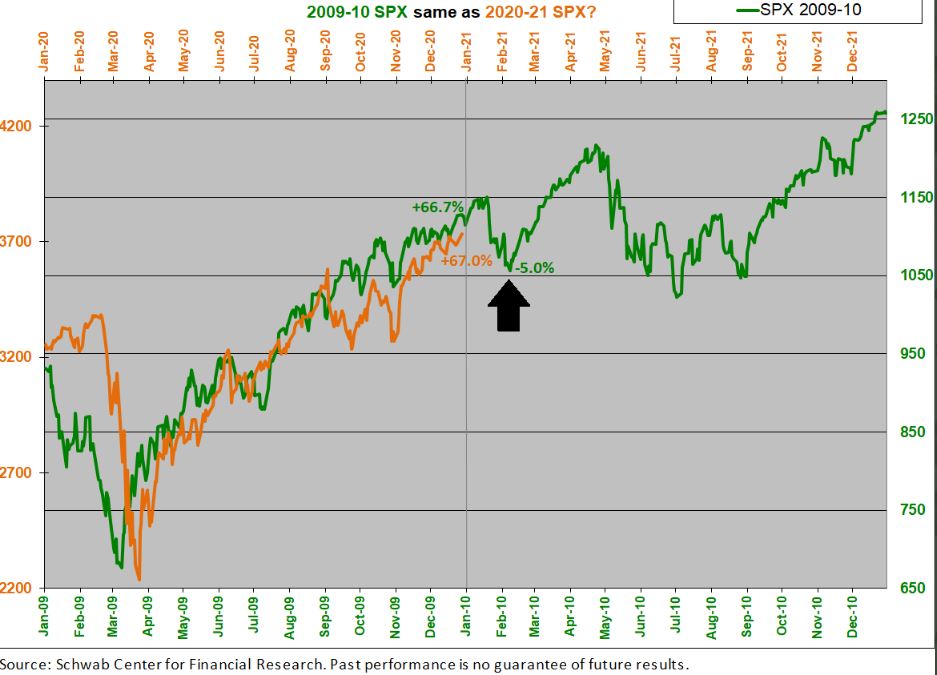

FYI, by no means am I saying 2009 is 2020. But it is interesting…

Here’s to a great 2021! Enjoy the three day weekend!

Follow us for daily updates: Twitter: @jonathan_gurney OR @gurneyfinancial Linked-In: Jonathan M. Gurney Facebook: Jonathan Micah Gurney OR Gurney Financial LLC

DISCLOSURE STATEMENT

This post is for informational use only. The views expressed are those of the author, Jonathan M. Gurney. This material is not intended to be relied upon as a forecast, research, or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed.