Good evening, I hope your week was fantastic!

To be honest, not a lot has changed in our stance as it relates to the market. We have talked about the “Catch-22” environment where price action in the market is strong, but the risk required to get upside returns is elevated. Our stance for the last month has been, “We could easily see a 1-3% above all-time highs, but it will require elevated risks to get there.” So for us, where performance hasn’t been great the first half of the year, I simply should not be taking high risks to the upside; whereas someone that has done well in the market can risk a bit more and slowly take gains. From a technical standpoint, S&P 500 futures $ES could touch $4270, $4330, and an extreme case of $4400 by end of summer.

With earnings season essentially over, all eyes are on economic data. This week the big headline that the market was waiting for was PMI (inflation) data. Despite the inflation data coming in higher-than-expected, the market continued to push higher. Oddly, the consensus view on the inflationary trade continuing higher took a breather this week and rotated to growth names. In short, the market rotated to growth names as yields pushed lower. To many, I believe the short-term decline in yields shocked the market, but was the healthiest thing that possibly could have happened for the market. As discussed in the last market commentary, the move toward the inflationary trade (financials, materials, industrials, and energy) seemed a bit overdone and overwhelmingly pressed by the media. So, in true market “head-fake” fashion, we got the higher inflation data and many of the positions that typically do well during high inflation, underperformed. As discussed prior, the rotations in the market are a pure “bull market” behavior. This is great price action. When one area of the market is taking a breather, we are rotating to areas that were short-term left for dead. In this case growth names, despite lagging this year in performance, have given the leaders a breather this year when it was desperately needed. This is not a market where you can focus on one area and expect it to do well for long periods. We are seeing quick pops and drops with nearly daily rotations. One needs to be broad-based or trade very quick or you will get chopped up.

Positioning all comes down to risk/reward. The economy is getting near fully recovered and that generally leads to a little “rinse” in the market. Despite what seems intuitive to the general public, the market does best when the economy has “low expectations.” We are now in a “high expectations” environment. High expectations generally lead to numbers that are difficult to beat. I expect earnings to be fantastic, but difficult to impress at these levels. The economy is strong, but the expectations are going to be difficult to maintain short-term. Last quarter’s earnings were unbelievable and many of the names still struggled to move higher. Ultimately, the normal average decline of (10)% seems reasonable at some point.

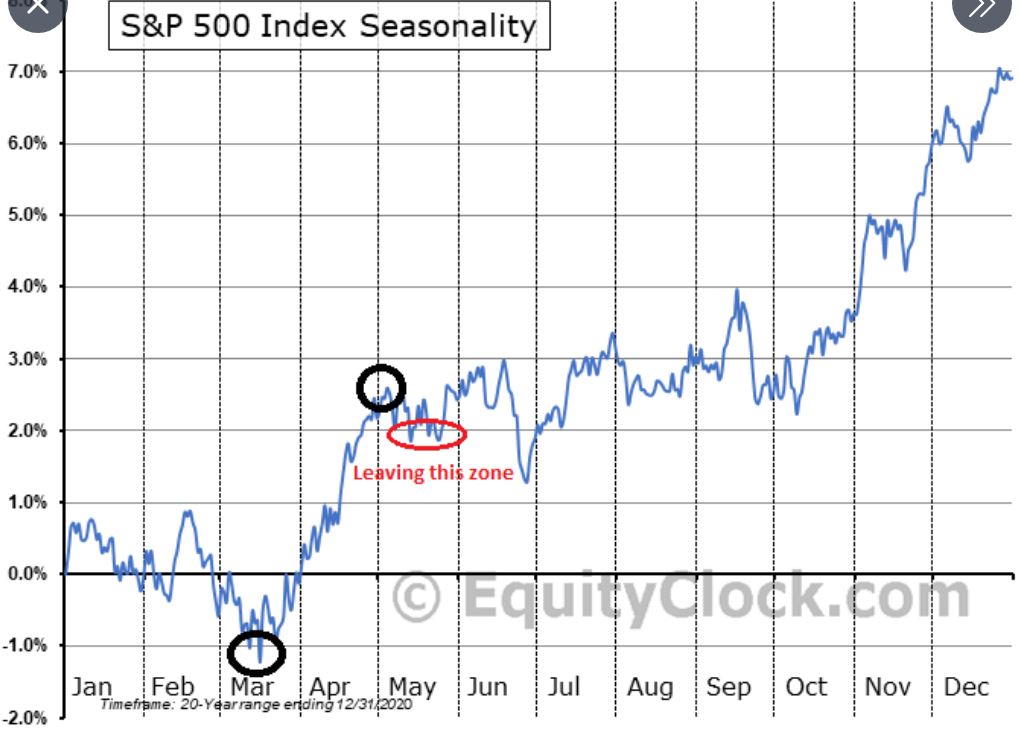

For clarity, I don’t expect anything like a (25)% decline; Simply a normal annual decline. With this said, the higher we go short-term, the more probable for a rapid rinse. When that happens, no one knows. Logically, it likely seasonally occurs during the mid-June cycle where we have a Fed meeting, rebalancing in indexes, quadruple witching (options expirations), and weak seasonality. Again, price action is strong and the economy is strong, so never get too bearish. Just when the market feels comfortable, the decline will happen and fool the majority. Based on many readings there is definitely complacency, but with the Fed pumping money into the system, it could last a bit longer. For me, this is not a great risk/reward area, but price action objectively is quite strong. From a risk/reward standpoint should $ES $4270 or $4330 touch, the risk/reward is more probable to the downside, in which we will allocate accordingly.

The Calendar Ahead:

- June 15-16 – Fed Meeting

- June 25 – Annual Russell 2000 rebalancing

- End of quarter positioning

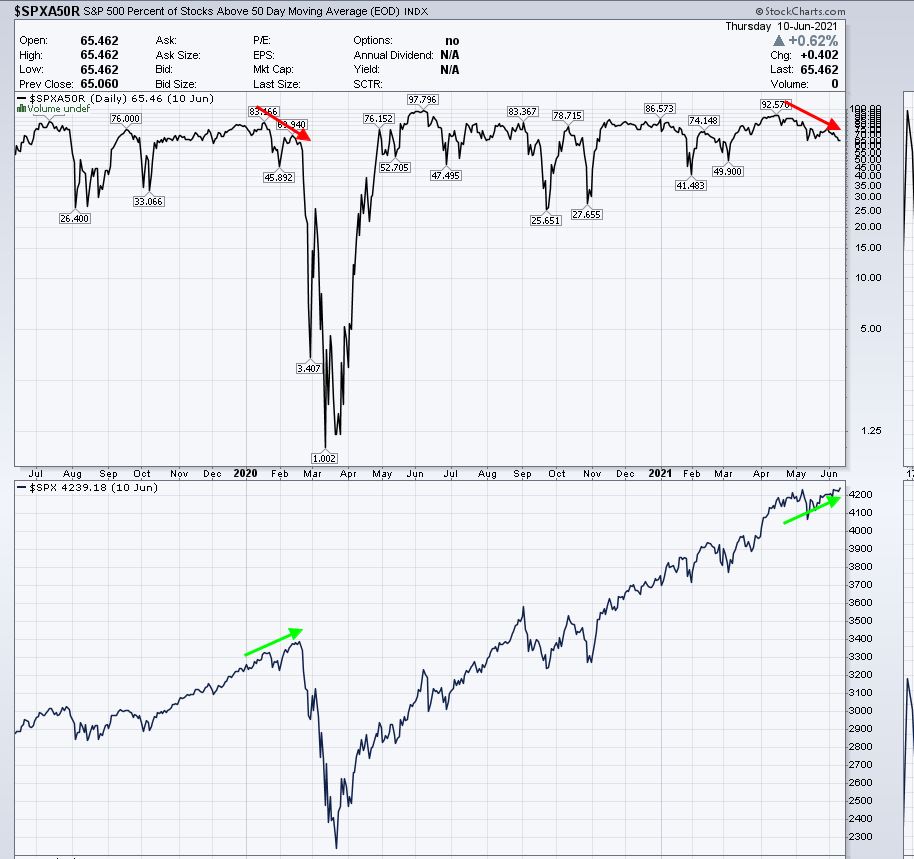

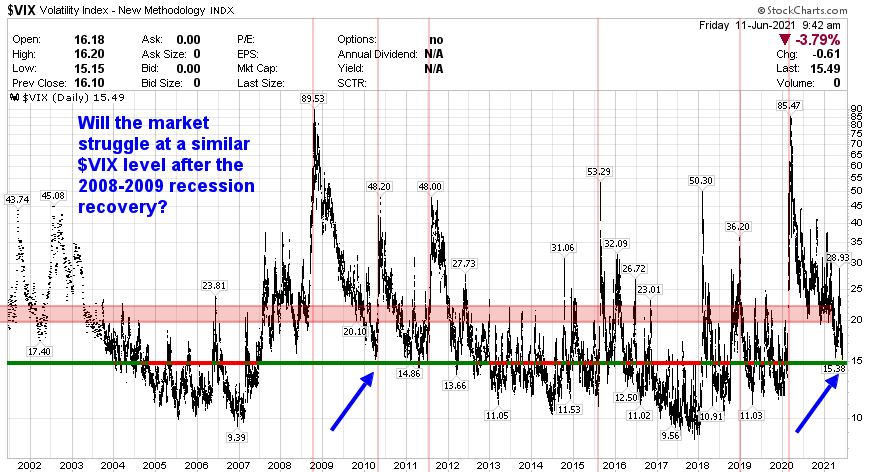

Price action currently shows no real issues. Are we seeing complacency in the put/call ratio and some weakness in breadth? Yes. This can last for awhile though; Hence why I believe the market may have a little more gas in the tank. A little more gas in the tank that requires a fair amount of risk. At this point I feel it is not wise to take this risk for clients. Wednesday, the put/call ratio saw two consecutive days below .40. The last time this occurred was February 8-11; a period that led to a few more days of growth then a bit of a struggle period.

Again, I don’t expect the market to tank. Simply a normal average annual decline of (10)%. Personally, I believe this would bring about a stronger market. I am simply waiting for better opportunities. If you have done well this year, you might be able to risk a bit more than I. If we go a bit higher, the better trade will likely be to the short side, unfortunately.

Divergence Notice: This is certainly something that is on our radar. For now, price action is winning.

S&P 500 Gaps that will eventually get tested:

Complacency Warnings?

Have a great weekend! Better opportunities to come, but it will require patience: weeks/months…

Thanks again for your trust and business! I will continue, as always, to search for high probability trades.

Follow us for daily updates: Twitter: @jonathan_gurney OR @gurneyfinancial Linked-In: Jonathan M. Gurney Facebook: Jonathan Micah Gurney OR Gurney Financial LLC Instagram: Jonathan M. Gurney

DISCLOSURE STATEMENT

This post is for informational use only. The views expressed are those of the author, Jonathan M. Gurney. This material is not intended to be relied upon as a forecast, research, or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed.