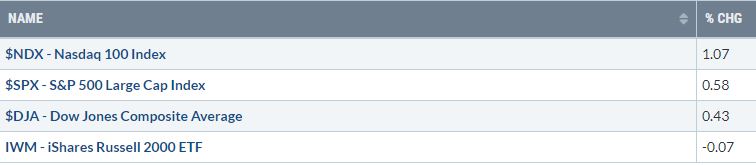

WEEKLY MAJOR U.S. INDEX PERFORMANCE

WEEKLY SECTOR PERFORMANCE

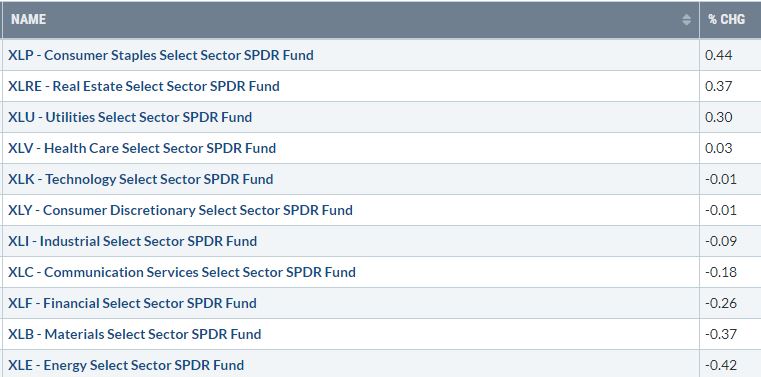

FRIDAY, 12.27.2019, SECTOR PERFORMANCE

When the market rallies the way we are currently experiencing, investors don’t complain. Even as an optimist during this trend higher, I am surprised we trickled this high short-term. Like I said, we are not complaining as we still has 70% invested. Friday, 12.27.2019, the S&P 500 tested as high as $3247.93, ran out of steam and closed at $3240.02. From a technical standpoint, while price action has been fantastic, short-term we are quite overbought with the $SPX Relative Strength Index (RSI) at 78.43. There have been times where we have had RSI’s higher than 78.43, but realistically, a little (2-3)% dip would not surprise me. It could be that risk-off assets in Real Estate $XLRE, Consumer Staples $XLP, Healthcare $XLV, and Utilities $XLU get a short-term bid. Our call mid-week for Gold $GLD to get a bid, did occur.

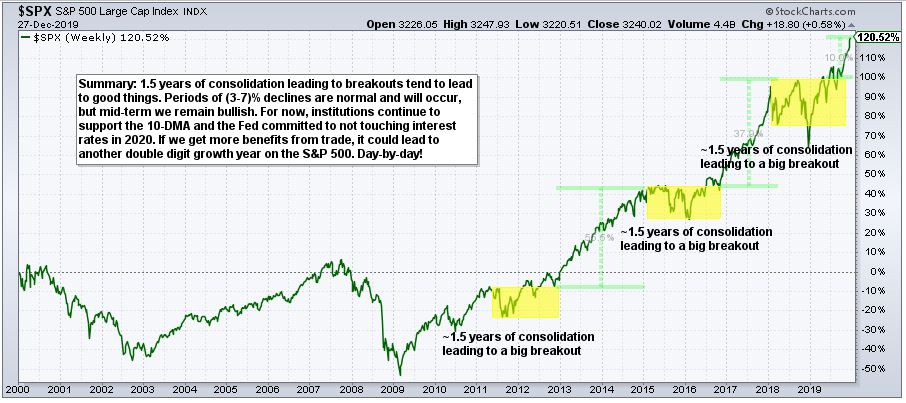

So where do we stand? Price action from a technical standpoint has been fantastic, but we are overbought short-term. Mid-term, there is close support below and we expect good things mid-term after a normal and healthy period of consolidation. Fundamentally, U.S. Economic data has been quite impressive and realistically advancements in trade is what pushed us higher after consolidating for 1.5 years. What you are experiencing here is a classic long period of consolidation with a breakout. As stressed several times, this tends to lead to good things (see chart below).

Short-term, it wouldn’t surprise me to see January be flat to down, then trickle higher. It will be interesting to see if we see peak highs in 2020 mid-year rather than at end of the year as a result of the election. Again, I don’t have a crystal ball and don’t claim to. Bottom line, my job is to be a realist, be objective, throw-out politics, keep clients grounded, and watch price action. After all, price action is the final word!

PUT/CALL RATIO

SUMMARY: End of year decisions can be a little tricky knowing it is tax harvesting season. It could be that taking some gains into year-end might be wise. Frankly, I wouldn’t mind moving some of our gains into 2020 (note this is not applicable to all clients nor accounts). Regardless, a little rebalance could occur making it an interesting end-of-year. I don’t expect anything exciting, but it is something we are watching. It is probably wise to raise some cash despite our bullish stance mid-term.

LESSON OF THE WEEK: This was a great reminder from Bespoke that came out this week. Credit where credit is due! 52.3% of all trading days thoughout the S&P 500’s history since 1928 have been “up-days” for the market. Despite only ~50% of trading days have been “up-days”, it has translated into a price change of 18,157% for the S&P 500. The summary here is quit trying to be an economist. DIPS WILL HAPPEN. It comes with averaging 7-9% a year on average within the S&P 500. Quit being a drama queen. Dips are going to happen. We will try our best to prevent the dips as much as possible, but we will never be perfect.

Thanks again, Bespoke.

Have a great weekend!