The upward trend continues as the S&P 500 consolidated sideways from Monday – Thursday of this week. Thursday, 12.19.2019, we finally closed above the $3200 level that we had been testing hard all week. The breakout spurred another boost Friday, 12.20.2019, closing up 0.49% to $3221. Not to be a broken record, but a 1.5 year period of consolidation tends to lead to better-than-expected results. This is what we are currently experiencing!

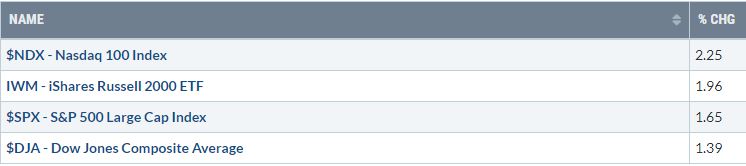

WEEKLY MAJOR INDEX PERFORMANCE

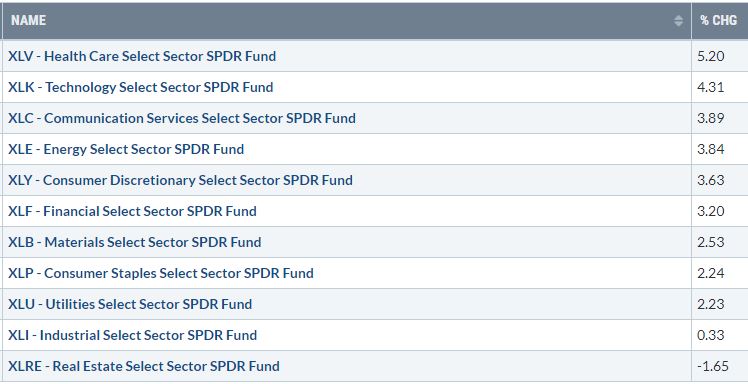

SECTOR PERFORMANCE – 3-MONTH PERSPECTIVE

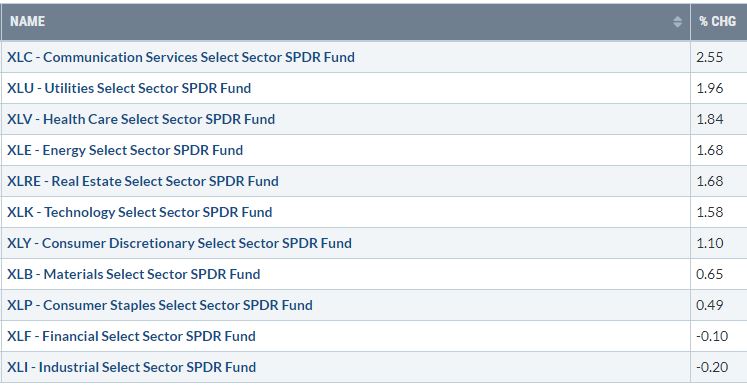

SECTOR PERFORMANCE – 1-MONTH PERSPECTIVE

SECTOR PERFORMANCE – 1-WEEK PERSPECTIVE

A shout-out to Bespoke, as it is always interesting analyzing the different indexes. As you can see, across all indexes, we are overbought. For clarity, we can become much more overbought. This does not mean stocks are overpriced. This is simply is a tracker monitoring the pace of the recent move. Because price action has been fantastic from a technical standpoint (a slow grind higher after testing lower key-levels), is the reasoning the “Bespoke Timing” indicates “Neutral” across most tracked indexes. As we go higher we will continue to trim. It could be that a nice refresh button might be wise into 2020 and reducing risk is likely the course of action we will take short-term.

FINAL REMARKS

From a Fundamental standpoint, the U.S. Economy is strong, thanks to a resilient consumer. Volatility will come about with the election and trade uncertainty. This does not mean you should be in cash during these times! Short-term, we expect to trim positions into year-end and will likely switch allocation to a more risk-off positioning short-term. Mid-term, we expect 2020 to be a decent year on the back of stable low interest rates, low analyst expectations in 2020, and large amounts of cash continue to remain on the sidelines. We are hoping corporate earnings will improve. Despite the economy doing well, this quarter was truthfully not great from an overall corporate earnings perspective.

As always, we strive to keep you balanced and open-mined to the realities. Our decisions are not politically driven, nor will they ever be. Consider your emotions the next few months knowing we will not time everything perfectly. We feel the current action is wise to slowly switch toward risk-off assets short-term. January, March, and July tend to be rough months. That doesn’t mean it will happen in 2020, but we will watch day-by-day and keep you apprised. If we miss a call, we will be honest about it and adjust as we need to.

It is quite funny how this end of the year is a complete opposite story of last year. People believed the world was ending last Christmas, and this year the same investors want to add as much cash as possible. This year is a classic FOMO story. Afterall, there is nothing like price to change sentiment. Keep the above in mind when you analyze your current emotions. Short-term, this is likely not a great entry! Long-term, it’s a different story.

Have a great weekend!

DISCLOSURE STATEMENT

This post is for informational use only. The views expressed are those of the author, Jonathan M. Gurney. This material is not intended to be relied upon as a forecast, research, or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed.