The Cliff Notes Version

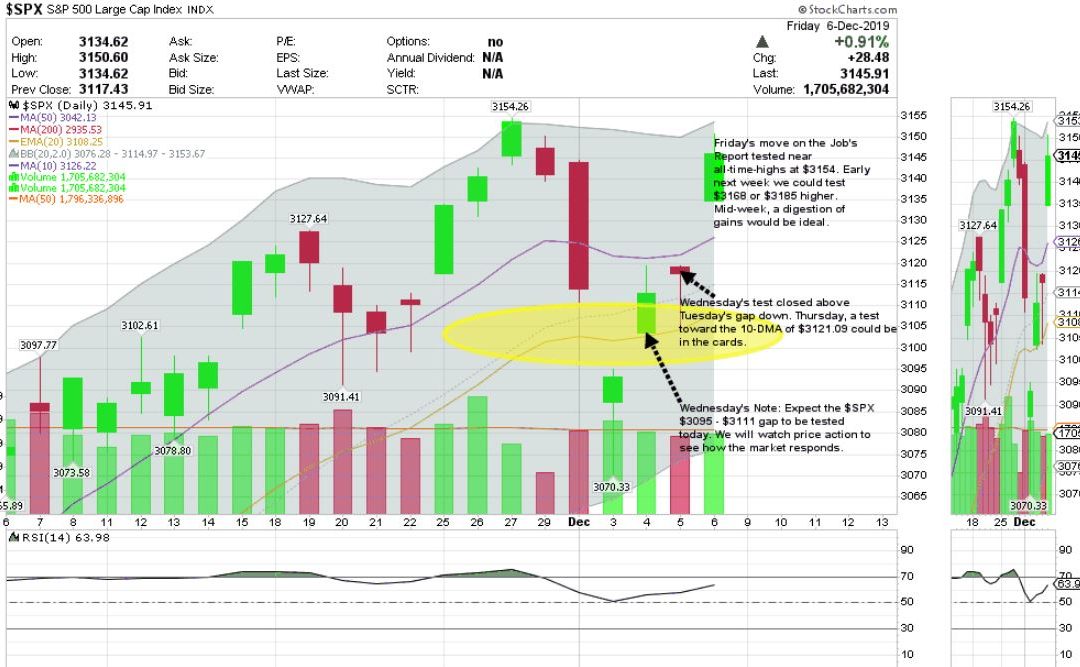

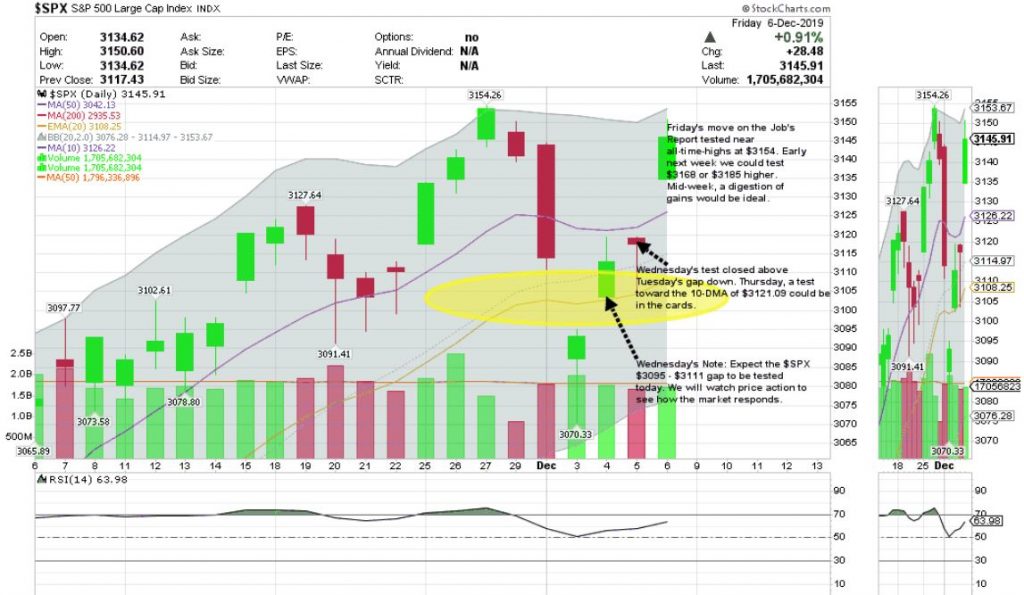

Summary: After trading down last Friday, Monday, and Tuesday, which equated to a downward move of ~(2-3)%, the later part of the week quickly erased almost all of the test lower down to the S&P 500’s $3070 level. The intra-day all-time-high on the S&P 500 is $3154.26 which was set mid-week last week (Thanksgiving week). After Friday’s, 12.6.2019, Jobs Report, of which some analysts are claiming to be the best report they have seen in over 50 years, along with optimism expressed through Kudlow’s interview regarding trade with China, the market’s resilience pushed us back near all-time highs. As stressed all of last week: “A (2-3)% dip could extend this rally and lead to better things.” While we were well positioned for the quick dip and we added a little on the dip, in hindsight I wish we had added more. Obviously, this is easy to say in hindsight! In reality, after the velocity of the Wednesday’s through Friday’s move higher, sideways movement would be healthy here once again. The next big obstacle we have to look forward to is whether the President will implement new tariffs if Phase 1 of the trade deal is not up-to his expectations. While this could be brutal for the market short-term, it might be best for our country long-term. The question that we continually ask ourselves is, “How much do we poke the bear?” The bear being China. Nevertheless, we aren’t in a horrible position form a negotiation standpoint.

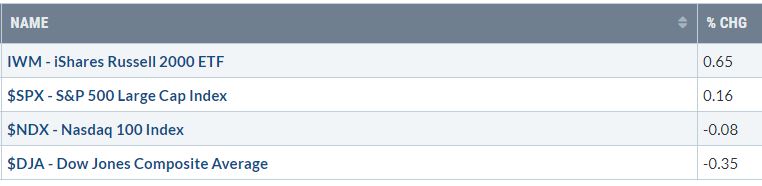

Weekly Major Index Performance:

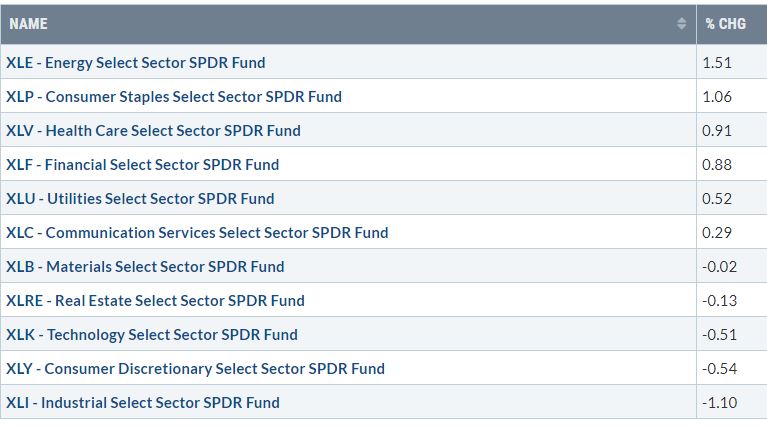

Weekly Major Sector Performance:

High-level Thoughts:

- Selling pressure continues to be supported by large institutional buying.

- Though there is political pressure in Healthcare names, the Healthcare Sector $XLV continues to act well and could serve as a decent hedge regardless of whether you are growth or value focused.

- Throughout the recent dip, it was encouraging to see the Russell 2000, small-caps, hold key support and lead us higher.

- The U.S. economy added 266,000 jobs in November vs. the estimated 180,000 new jobs. The jobless rate fell back to a 50-year low of 3.5% after a brief October uptick. Meanwhile wages increased 3.1% annually. The growth in the jobs and wages report was quite impressive and could lead us into an extended rally. As stated several times, (2-3)% dips are normal and happen several times a year. These dips typically lead to better, more sustainable up-trends.

- For those that are calling this “the rally over 10-years that will end horribly,” please understand the following: The duration of any rally is really a dumb argument. You’re forgetting we have had several resets along the way. Who defines the length of a recession or the amount of loss in a bear market and how? Don’t forget the S&P 500 lost (20)% in 2018. The point being, consider the back-drop and understand we have traded sideways for 1.5 years and are finally breaking-out. Could this be the start of a new up-trend? Mid-term it wouldn’t surprise me, but we will as always take an unbiased approach and watch price action day-by-day.

- Growth-names are still building bases and if they decide to take-off, this could lead the entire market higher mid-term. The divergence between growth-names and value-names remains intriguing. Value names are outperforming significantly within a short-term time-frame.

- We will be keeping an eye on Financials $XLF, as they are breaking-out and could push higher. A bid in Financials $XLF and Industrials $XLI could be in the cards and push the entire market higher.

- THE REALITY: Sideways movement after an impressive come-back wouldn’t surprise me. We might touch as high as $3185 short-term, get overbought and lead to a little breather once again. Overall, we are ready to add on any dips as the backdrop remains strong. Trade will be the focus!

- Don’t be shocked if the S&P 500 $3117 gap-up level is tested. Once again, there is a lot of support below from a technical standpoint.

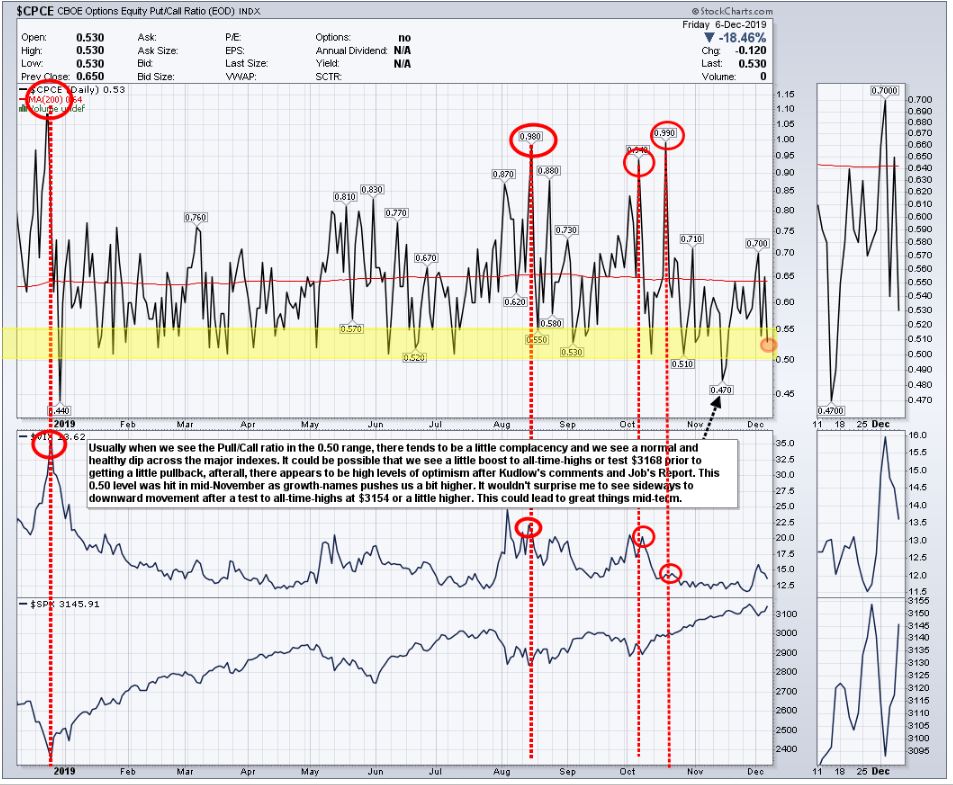

- Here is a quick look at the Put/Call ratio. After this rally, we are close to a complacent state short-term, though mid-term we expect the market to move higher. As always, this analysis is contingent on short-term trade headlines. This is why we try to go into the day with a open-mind each day!

- Overall, from a technical standpoint things remain quite strong, yet are close to being overbought in the short-term. We could push a little more higher short-term before sideways movement. Fundamentals from an economical standpoint remain robust, though corporate earnings for this quarter were mediocre at best. Hopefully, the lower interest rate environment aids in corporation’s bottom line and sales. The consumer at this time remains strong!

- Stay discipline my friends! Use price action to keep you from making dumb emotional decisions. This is why we keep you aware daily of key levels to watch. Price action is the final word!

Ask questions! We are here for you. Have a great weekend.

STOCK OF THE WEEK UPDATE: $ULTA

===================================================

DISCLOSURE STATEMENT

This post is for informational use only. The views expressed are those of the author, Jonathan M. Gurney. This material is not intended to be relied upon as a forecast, research, or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed.