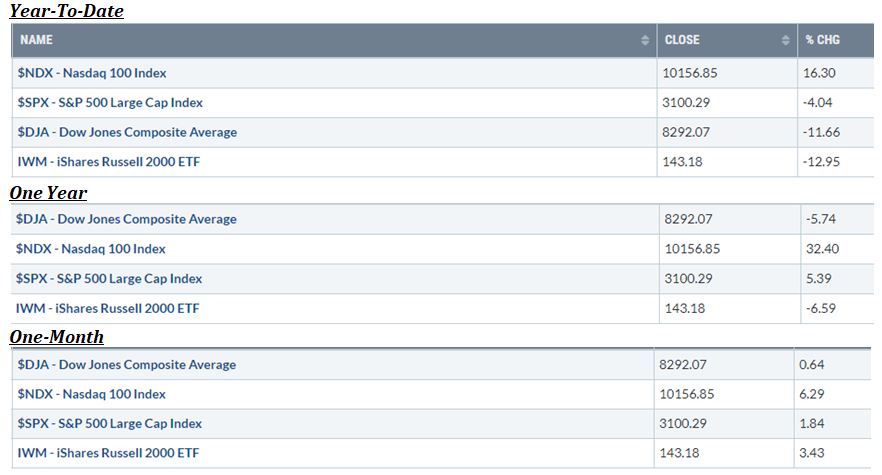

The Real Perspective (based on quarter end):

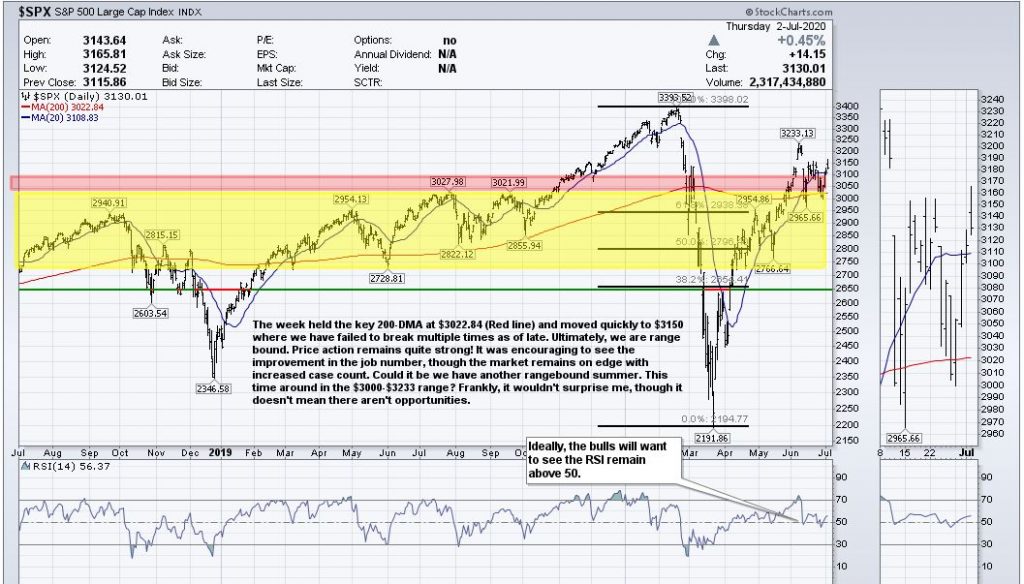

S&P 500 – Longer-term Perspective

S&P 500 – 20 Day 5 minute Candle

Put/Call Ratio

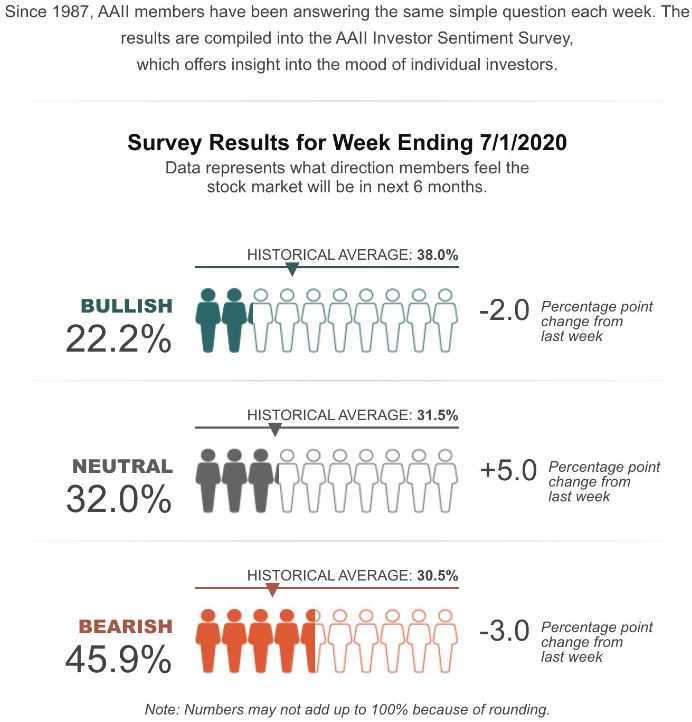

AAII Sentiment Survey

Interesting NASDAQ Perspective: Not an immediate sell!

Current Positioning: As the S&P 500 approached $3150 and failed, we added a hedge by shorting the Russell 2000. While it didn’t lead to a great performance the past few days, we believe the protection is warranted given the increase case count. The purpose of this position is not necessarily that we believe the market is going lower, but rather allows us to hold onto our positions while protecting value should we go lower. In other words, if we break $3150 on the S&P 500, I will likely sell the Russell 2000 (Small Caps) hedge. $3150 is a big level. A level we continue to struggle at. I make no assumptions, as the market is holding-up well despite the poor case count.

Why the hedge on the Russell 2000? The basic thought is financials and small companies will struggle the most should case count increase and more government mandates take place. This is a short-term play for protection. I hope this position does poorly so I can keep the other positions going strong. I know this is a different mindset for many clients, though I believe it is a good risk-to-reward insurance play given the most recent week rally. End of quarter leads to several rebalances and new flows into the new quarter. After an impressive week performance, a (1-2)% dip wouldn’t be uncommon. If this occurs, I take my gain in the hedge and will likely add to a more bullish stance should price action suggest it.

Friday, 7.2.2020, we were net sellers once we saw $3150 didn’t hold. Could it be we pierce through this week? If case count improves, yes! Case count is the one thing holding us back. A forewarning that the next rally could come from the beaten down names, as many “stay-at-home” momentum names are overbought and need a breather. Should improvement come in case count, you’re going to likely see alpha in the “have nots”; banks, casinos, travel stocks, and small caps.

This next week will be interesting! As always, we will watch price action. Thus far, price action is holding-up well. S&P 500 $3150 is the line in the sand. I hope it goes higher, but we are simply adding a hedge in case it doesn’t pierce though. Global equities are recovering and showing impressive price action. For American equities to take the next leg, case count will be important.

Have a great weekend! We appreciate your support!

#investing #invest #stock #stocks #trade #trading #economy #wealth #indexing #indexes #finance #finances #charts #charting #money #monies #market #business #sectors #tariffs #gold #treasuries #wealthmanagment #financialplanning

Follow us for daily updates: Twitter: @jonathan_gurney OR @gurneyfinancial Linked-In: Jonathan M. Gurney Facebook: Jonathan Micah Gurney OR Gurney Financial LLC Instagram: Jonathan M. Gurney

DISCLOSURE STATEMENT

This post is for informational use only. The views expressed are those of the author, Jonathan M. Gurney. This material is not intended to be relied upon as a forecast, research, or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed.