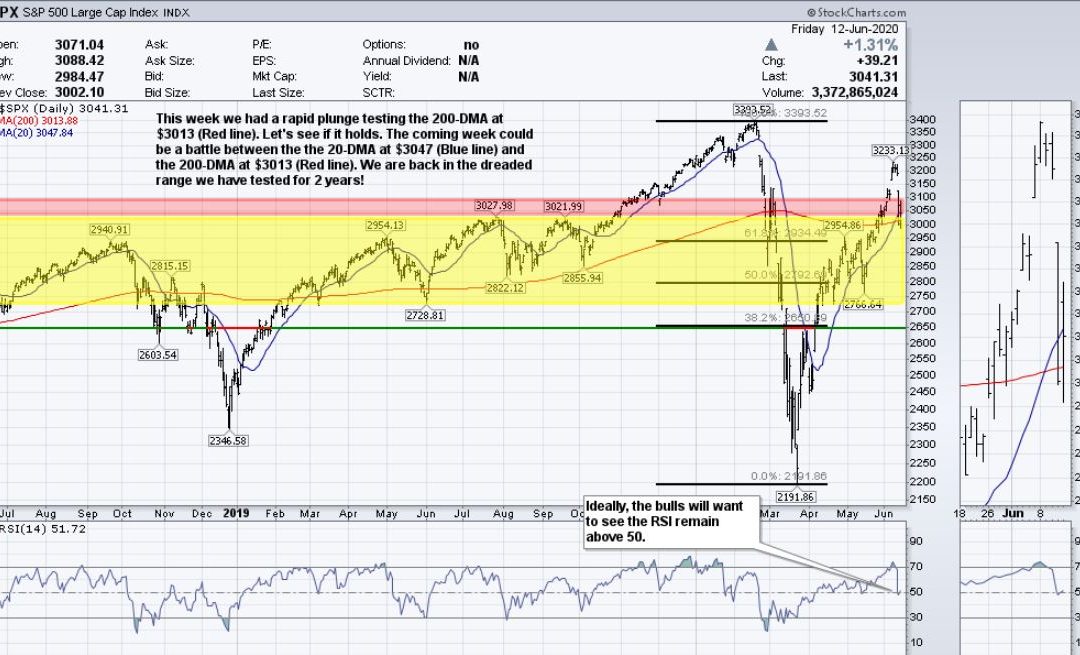

Happy Saturday friends and clients. It was an ugly week in the stock market! We were fortunate to trim down to 5% invested prior to the plunge. Did we time it perfect? No. It seems to be a reoccurring theme that we tend to get out or reduce positions about 3-5 days early. Clients, this week’s dip did not hit us hard. On a day where the market falls (5-7)%, like it did on Thursday, it is a good opportunity to add to core positions. We added 15%. Friday, 6.12.2020, the tape was all over the place. From a price action stand point, we are in a tough spot between the 200-Day Moving Average (DMA) at $3013 and the 20-DMA at $3047. Friday traded in waves of big buying and selling. In short, the day was a day for patience; no buying nor selling. We are in the dreaded range between $2728-$3100. This has been a brutal range of testing over the past 2 years. These tests lead to good things! It could be an interesting June through September, which historically have been mediocre performance months.

What I would like to see and what will likely happen in the stock market are two very different things. This is why we follow price action! I don’t have a crystal ball and don’t claim to have one. I would like to see consolidation or sideways movement leading to a more sustainable rally. When the put/call ratio gets in the 40’s and the Relative Strength Index (RSI) gets over 70, the market is typically close to a little dip; even if there is no real standout catalyst. Whether the dip was caused by the Fed stating rates would essentially remain at 0% through 2022 or the fact that virus case count increased is truthfully a pointless debate. We were overbought and, therefore, we reduced our positions from 40% to 5%, and added 15% after the big dip on Thursday. Being cautious when seeing extreme levels are touched is a part of our process and strategy. With this said, I admittedly did trim a bit early on the way up; a tough one to stomach. Fortunately, we did well on the way down. We learn from it and remember. With this said, we certainly did not want to chase the rally to extreme levels. After a reasonable dip, we added 15% Thursday and will continue to add on dips. With $5 trillion assets remaining in cash, I have a hard time believing we get more than a (10-12)% pullback [currently a 5.9% dip from where the S&P 500 closed Friday; $3233.13 (recent peak) to $3041.31 (Friday’s close)]. If we see more of a pullback and key levels are broken, we will adjust.

For now, on dips we will continue to add to our core positions. Short-term, I do not believe this will be a race to all-time highs. We want to make this next point clear. When we are cautious about the market, it does not mean we are betting against the economy! The market was priced to perfection prior to Thursday. Consider how far the market has been removed from the true economic problems we are facing. The market has rallied over 40% off the lows and the Nasdaq surpassed all-time highs. Amazing. Insane. Impressive… call it what you want. The market is not the economy! So, when we say a little pain could come in the market, it has nothing to do with our stance on the economy. The U.S. will thrive and the market will continue to perform long-term. If I can help manage risk during extreme overbought and oversold levels, I am going to try to take advance of the opportunity. I believe we could be in for some frustrating sideways movement. With this said, there are short-term opportunities. By year-end reaching at all-time highs on the S&P 500 would not surprise me. Overall, short-term we hope there is sideways movement to a little downside and we will add more. If the 20-DMA is regained continues to hold, we will likely add more. Mid and long-term, the Fed is accommodative and looks to remain this way. This is a good environment for equities.

We are watching closely and will keep you apprised, as always. Weeks like this stink for many investors, but we were extremely fortunate to not get hit hard as we only had 5% invested at the time and added on the dip.

Have a great weekend and please contact me should you have questions or concerns.

Follow us for daily updates: Twitter: @jonathan_gurney OR @gurneyfinancial Linked-In: Jonathan M. Gurney Facebook: Jonathan Micah Gurney OR Gurney Financial LLC Instagram: Jonathan M. Gurney

DISCLOSURE STATEMENT

This post is for informational use only. The views expressed are those of the author, Jonathan M. Gurney. This material is not intended to be relied upon as a forecast, research, or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed.