As stressed Monday, 2.10.2020, if we breakout past $SPX $3334, look for a test toward all-time highs. This is what happened with the S&P 500 closing up 0.73% to $3352.09. Let’s see if we struggle at $3365 today. If you were to look at a chart over the past 3 weeks, I bet many of you wouldn’t have expected the S&P 500 to virtually be flat to slightly higher. The point being, don’t be overly bearish or bullish. The extremes tend to lead to dumb decisions! If you thought the world was ending because of Coronavirus, watching price action would have helped you. Remember, the market doesn’t care what you think. We follow institutional key levels for a reason! Take out the drama and recognize that a (3-10)% decline is not a recession. These are healthy periods of retesting gains!

So where do we stand? Truthfully, it is a mixed picture, which is why we are about 65% invested and have 35% ready to pounce on dips. On one hand you have somewhat complacent levels in the Put/Call ratio, while on the other hand active managers have approximately 39% in cash vs. the 2% in cash toward the end of 2019. The point being, there are a lot of mixed signals and during these times we tend to raise some cash from a risk-reward perspective. There is nothing wrong in taking some gains in order to have dry-powder for random dips. They will come! Interesting fact of the day: Microsoft, Apple, Amazon, and Google have made for 67% of the YTD S&P 500 gains. Despite the market performing well as a whole, you’re seeing super-cap names are driving this. Oddly enough, despite being at all-time highs, only 64.13% of S&P 500 stocks are above their 50-day moving average.

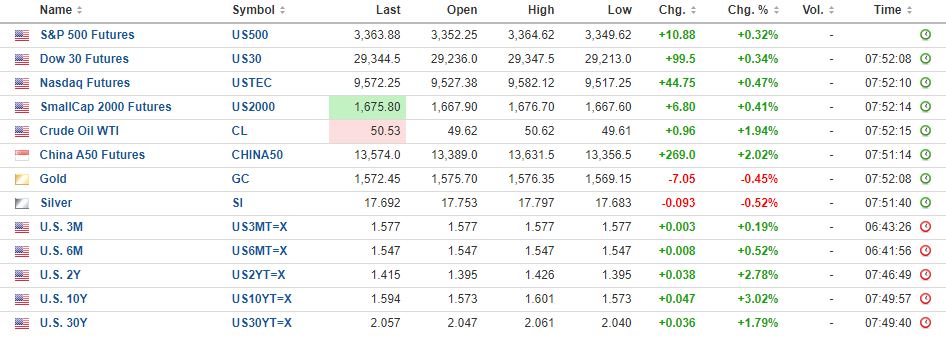

In summary, be careful assuming everything is overbought. The next few weeks will be interesting! Today it was reported that China may have to delay U.S farm purchases as agreed upon in the trade deal due to Coronavirus. Meanwhile China is allowing local governments to sell another $122BN of debt before March to offset the impact of Coronavirus. Today and tomorrow we also hear from the Fed. For the time being, risk-on assets continue to outpace.

Have an open-mind each day and you’ll be better off as an investor.