THE WEEKEND REPORT: So, where do we go from here?

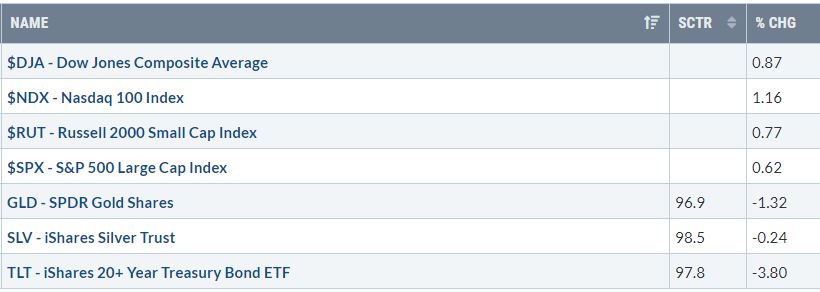

As you can see below, we posted a nice comeback in the latter portion of the week leading to a positive returns across all Major U.S. Index (The Dow, S&P 500, Nasdaq, & Russell 2000). As expected, Gold (GLD), Silver, and the 20+ year treasury bond ETF (TLT) took a little breather. In short, it was encouraging to see equities get a slight bid toward the latter part of the week, while more conservative areas lagged. As stressed several times, we believe the leaders in growth need to show strength for the market to continue its upward trajectory.

Meanwhile, some of the risk-on sectors (Technology, Consumer Discretionary, & Communication Services) got a bid this week, while lower risk areas struggled. Let’s see if we can get follow through in risk-on assets over the next couple of weeks.

While this week was an encouraging start, “under the hood” it appears more chop will likely continue. Seeing the S&P 500, Nasdaq, and Dow all above their respective 50-day moving averages (DMA’s), keeps us tilted bullish short-term; though let’s be real, one news event will send the market testing lower levels. Be open-minded to this!

While it is important to be in tune with the headlines, price action is the final word. Afterall, “there is nothing like price to change sentiment”. In short, the general public tends to feel good about the market when the market does well. Conversely, a (5)% dip leads many to believe the world is ending; when in reality this occurs on average three times a year. While we are positioned well for this recent move higher, there remain concerns that we will be upfront about. Could this be another “sell the news” situation where we simply reduce the upcoming tariffs and the market sells-off, similar to May 2019? I don’t know! You don’t know! They don’t know! But… we will be open-minded to this potential price movement lower. It would not surprise me if we tested this recent gap-up $2960-2940 level for support. On 10.7.2019, we were in this same position with almost the same gap-up (illustrated below). A test here could be healthy! Seeing the Relative Strength Index (RSI) remain above 50 would be ideal (bottom of chart with yellow circle).

After a strong close to the week, it wouldn’t be surprising to see test lower before going higher. At this point, we are headline driven, which can be an emotional period for investors. In reality, we are simply testing key technical levels. While we had an impressive close to the week, expect more chop. Bottom line, while Friday was a nice tick higher, the follow through day was not on large volume nor decisive. At this point, it did not appear as if institutional buying came back with conviction. While we love the progress, the leaders are in the grind of attempting to build bases. In time!

As you can see in the chart below, the National Association of Active Investment Managers weekly survey of overall equity exposure, with only 57.32% of portfolios being allocated to equities. Again, this is a more narrow perspective, but interesting nonetheless. In short, the Street remains cautious while the market searches for direction; and understandably.

So, where do we go from here?

With a possibility for small wins in trade with China, the Fed using quantitative easing, the Fed keeping rates low, and the fact that we are headed into a seasonally strong fourth quarter, keeps us slightly bullish, yet cautious. In addition, seeing sentiment negative while many are under-invested could be ideal from a contrarian standpoint. Despite the recent chop we have the S&P 500, Nasdaq, & Dow, all are above their 50-DMA’s. While Friday’s follow through day was encouraging, it could take weeks for the growth names in each sector to establish bases. It was encouraging to see steps in the right direction, but it would have been ideal to see more conviction in institutional buying on volume Friday. In time! Price action of leaders over the coming weeks will help determine if this rally is sustainable. Remember, (2), (5)%, (10)% corrections occur almost every year. Bottom line, short-term expect more chop as the market searches for direction; though mid-term, we like the set-up going into the next earnings season with low expectations. Small wins in trade negotiations with China would be encouraging. Day by day! As always, we hope to give a balanced approach while being open-minded to price movements in either direction.

=========================

DISCLOSURE STATEMENT

This post is for informational use only. The views expressed are those of the author, Jonathan M. Gurney. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed.